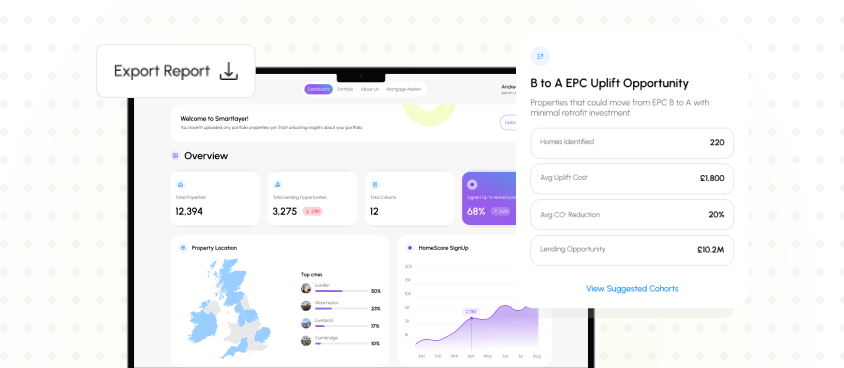

Smartlayer is building the Bank of tomorrow - a transparent, data-powered platform that empowers banks, homeowners, and institutions alike. Our mission: to make every home a financially intelligent asset.

Live

Alex Smith

Scroll Down

What is Smartlayer?

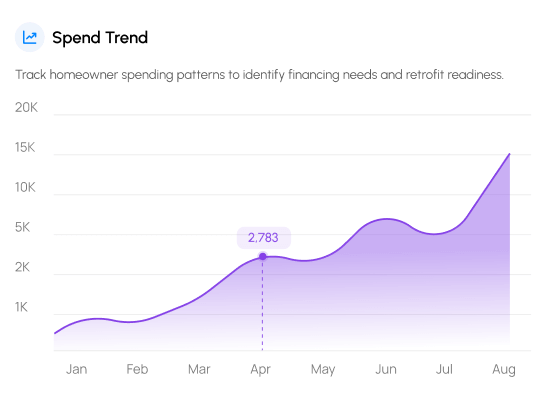

Smartlayer connects banks, platforms, and property owners through real-time data and shared financial insight. With Homescore as its foundation, we help institutions make smarter lending decisions - and help individuals unlock the full financial potential of their homes.

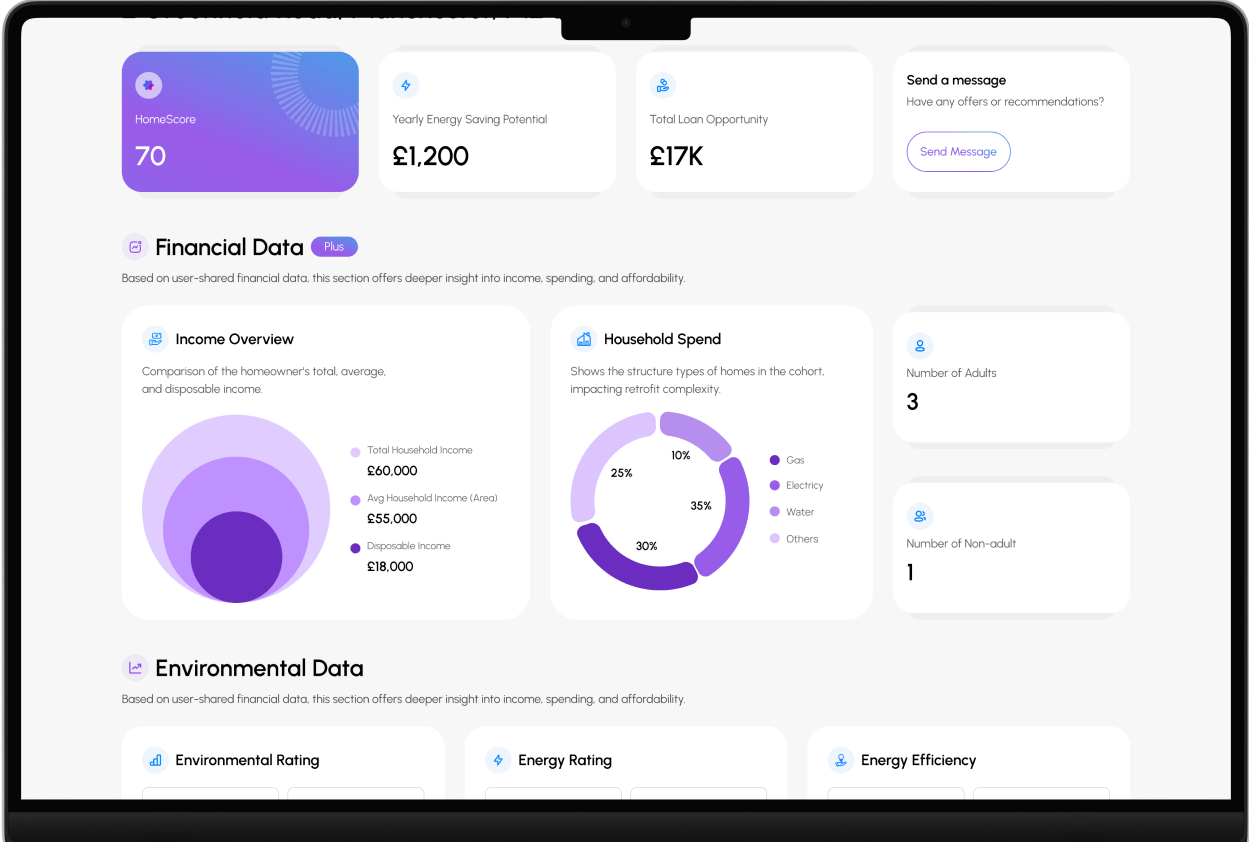

We give banks the tools to assess home and borrower readiness in real time. Homescore brings dynamic property intelligence into underwriting, enabling faster credit decisions.

Opportunities

With Smartlayer’s Homescore at the center, you gain a clear, real-time view of property readiness, financial performance, and lending potential - built to serve individuals, banks, and platforms alike.

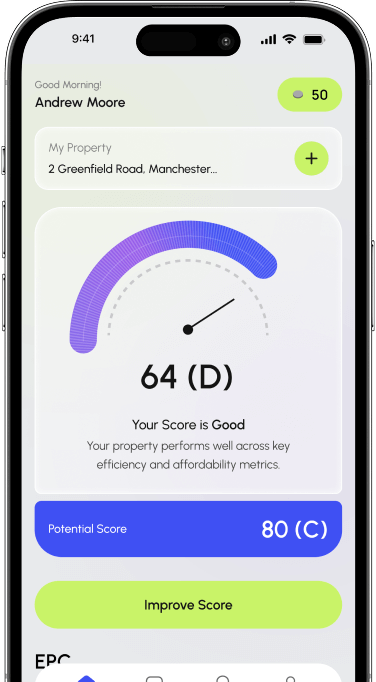

Get a transparent Homescore based on real property and owner data - not just credit history.

Monitor your score over time, identify ways to improve it, and unlock access to better financial products.

Homescore goes beyond the surface-analyzing local market signals to give a true picture of your home’s health.

Use Smartlayer APIs and infrastructure to deliver smarter, more personalized financial services.

Why HomeScore?

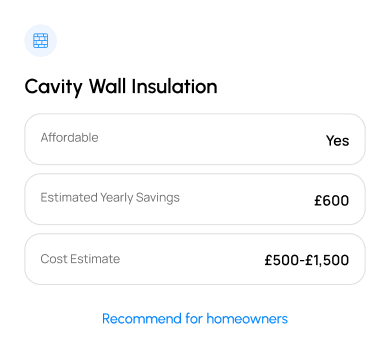

Traditional credit models overlook key factors that impact housing risk and value. Homescore fills that gap. It’s a comprehensive, real-time score that reflects the condition, behavior, and financial performance of both the home and its owner.

Gas

Electricy

Your Score is Good

Your property performs well across key efficiency and affordability metrics.

Built for resilience and transparency, Smartlayer helps households, banks, and platforms operate on real-time truth - not outdated scores or static assumptions. With Homescore, we enable smarter lending, better ownership decisions, and long-term financial efficiency across the entire housing economy.